7 Best Micro Investing Apps for Beginner Investors [Reviewed]

- webymoneycom

- Dec 3, 2023

- 40 min read

Updated: Dec 23, 2024

Forget the headlines of those who got rich quickly by trading hot stocks - you should take note of the millions of people who achieve financial success quietly and deliberately. They understand that the path to wealth starts small, but the effects compound exponentially over time. They can build strong economic foundations and watch their wealth grow by taking small but consistent steps.

Are you curious how millions have achieved financial success by investing such a small amount?

Well, you can too! In this Blog, you will uncover the secrets of building wealth with a minimal investment. Uncover the strategies and techniques that have enabled countless people to succeed financially, and start your journey toward financial freedom today!

Investing can seem intimidating, but it's essential to any financial plan.

Fortunately, with micro-investment apps, Starting doesn't necessitate enormous amounts of money.

Micro-investing is an approach that involves putting small amounts of money into the market. This is a great way to save for retirement, whether through an employer-provided 401(k), an IRA, or even an additional app.

To make micro-investing easy for everyone, some great apps are worth checking out. They range from hands-off investments to allowing you complete control of your assets.

I'll discuss the best micro-investing apps to help you take those first few steps toward a financially secure retirement. It's always early enough to start investing in your future.

By taking the initiative to make small investments now, you are helping to set yourself up for a more comfortable retirement later on. The sooner you start, the more time your investments will compound and impact your future.

Let the stories of people making huge sums of money through stock trading outweigh the importance of making small, regular investments for retirement.

With the right micro-investing app, you can make a plan, start early, and watch your money grow over time.

Let's Get Started!

What are micro-investing apps?

Micro-investing apps are smartphone applications that allow users to fund small amounts of money in stocks, exchange-traded funds (ETFs), or cryptocurrencies. These apps typically need users to link their bank accounts and use automated investing tools to help them select investments that fit their goals and risk tolerance. Examples of micro-investing apps include Acorns, Stash, and Robinhood.

Micro-investing apps appeal to younger generations and those with limited funds, enabling investors to start investing small amounts of money. They are designed to be user-friendly and accessible to anyone with a smartphone, making investing more accessible.

Micro-investing apps typically offer a range of investment options tailored to the user's investment goals and risk tolerance, such as portfolios of low-cost ETFs or individual stocks. The apps may also offer automated portfolio management, where users choose a portfolio that suits their goals and risk profile. The app will automatically rebalance their portfolio as necessary.

Micro-investing apps also frequently offer educational resources and investment guidance so users can develop their investment knowledge and skills over time. Many micro-investing apps charge fees, so reading the fine print and comparing fees before signing up is essential.

Benefits of Micro Investing

You may be curious about why you should get into micro-investing and what advantages you might gain from utilizing micro-investing apps.

Here are several benefits to consider when making your decision:

Accessibility: One of the most significant benefits of micro-investing is its accessibility. With a low minimum investment requirement and low fees, individuals needing access to more substantial amounts of money can still start investing. Some micro-investing apps allow users to invest with as little as $5.

Low cost: Micro-investing is much more affordable than traditional investment methods. Most micro-investing apps charge low or no fees, making it easy and accessible for people to start investing.

Convenience: Another significant benefit of micro-investing is its convenience. Users can access their accounts and complete trades on their smartphones, making it easy to invest and manage their portfolios from virtually anywhere.

Automated Investing: Many micro-investing apps use automated investing tools to help users select and manage their investments. This takes some guesswork out of investing and ensures that portfolios are balanced and diversified.

Education: Most micro-investing apps offer a variety of educational resources, including investing articles and tutorials. This gives users the knowledge and tools they need to make informed investment decisions.

Diversification: Micro-investing allows users to build a diversified portfolio even with small amounts of money. Because most micro-investing apps offer a range of investment options, users can invest in different asset classes and spread their risk across multiple investments. This increases the likelihood of a higher return on investment in the long run.

Potential returns: The potential returns from micro-investing can benefit many investors. While micro-investing typically involves smaller amounts of money, those investments can still generate substantial returns over time. Historically, the stock market has given investors an annual return of over 7-10%. Investing in diversified portfolios of low-cost ETFs or index funds through a micro-investing app can effectively capture this return over time. While individual returns will vary based on the performance of the specific investments and the timing of contributions and withdrawals, the power of compounding interest is crucial in generating returns over an extended investment period. Over time, even negligible, regular investments can accumulate and earn substantial returns.

7 Best Micro Investing Apps

Ready to get started with micro-investing?

Look at these 7 best micro-investing apps to find the one right for you.

Discover what you need to know about each, from the profits you can earn to the features and fees associated with each app.

1. Robinhood

2. Betterment

3. Linqto

4. M1 Finance

5. Firstrade

6. LendingClub

7. Red Lion Capital

1. Robinhood

Robinhood is a mobile application allowing traders to purchase and sell stocks, ETFs, options, and cryptocurrencies without paying commission fees. The platform was designed with a simple interface and user-friendly tools to help make investing more accessible to the masses. With Robinhood, users can invest in various stocks and other investment products without paying the fees typically associated with traditional brokerage firms.

Robinhood has gained popularity, particularly among younger investors, due to its mobile-first approach and ease of use. Robinhood's pricing structure is also unique in the brokerage industry, as the platform charges no commissions for trading stocks or ETFs and no account minimums or fees. This means that investors can use the platform to invest small amounts of money since they don't have to worry about the costs of making small trades.

Robinhood also offers a vast range of educational resources and tools to help investors learn how to make informed investment decisions. For example, the Robinhood platform provides access to various research and market data, including analyst ratings and historical stock prices. With these resources, investors can better evaluate potential investment possibilities and make more informed investment decisions.

Financial assets you can buy on Robinhood include:

Robinhood allows users to buy and sell diverse financial assets, including:

Stocks: Robinhood offers trading in stocks listed on major U.S. exchanges like the New York Stock Exchange (NYSE) and NASDAQ. Users can buy and sell stocks in individual companies, executing trades in real-time during regular trading hours.

Exchange-Traded Funds (ETFs): ETFs track a collection of stocks or other financial assets. When investing in an ETF, you buy a basket of securities rather than investing in individual companies.

Options: Robinhood allows users to trade options, contracts, and agreements that give the buyer the right to sell or buy a stock at a fixed price on a particular date. Options are a more complex asset class than stocks or ETFs, and trading options carry additional risks. With Robinhood, users can trade both calls and put options on stocks, ETFs, and index options.

Cryptocurrencies: Robinhood supports cryptocurrency trading, including Bitcoin, Ethereum, and Litecoin. Users can buy and sell cryptocurrencies alongside traditional financial assets and track their cryptocurrency holdings' value in the same app as their other investments.

Fractional Shares: Robinhood also offers fractional shares, which enable investors to buy and sell small portions of individual stocks or ETFs. This can make investing in high-priced stocks and ETFs easier and allow investors to build diversified portfolios with smaller amounts of money.

How much can you earn with Robinhood?

The amount an investor can earn with Robinhood will depend on factors such as money invested, the selection of investments, and market conditions. It's essential to remember that investing always carries some risk, and no investment is guaranteed to provide a particular return.

Historically, the stock market has given average annual returns of around 7-10%. Robinhood users who invest in diversified portfolios of stocks and exchange-traded funds (ETFs) can expect to earn similar returns over time. Investors can use Robinhood's research tools, such as historical price charts and analyst ratings, to select investments that fit their investment goals and risk tolerance.

Investors must set realistic goals and maintain a long-term perspective when investing in Robinhood or any other investment platform. An investor's earnings will also depend on how much they invest and how often they contribute to their investment account.

What does Robinhood offer?

1. Crypto

Robinhood offers 24/7 commission-free trading for the seven most famous cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, and more. This means you can purchase and sell cryptocurrency anytime without worrying about paying commission fees.

In addition to commission-free trading, Robinhood's easy-to-use interface and intuitive mobile app make it a popular choice for cryptocurrency investors of all levels. With real-time market data and intelligent notifications for price changes, Robinhood ensures users have the most up-to-date information for their investments.

2. Robinhood Retirement

Robinhood Retirement now offers Individual Retirement Accounts (IRAs) and Roth IRAs, bringing the convenience of its brokerage account to retirement planning. While it comes up short compared to other IRA providers in terms of investment options—offering only stocks and ETFs, while mutual funds are currently unavailable—it stands out with its 1% match on contributions up to the IRS’s annual limits.

This match is applied to any contribution you make and is almost immediate, without taking up your contribution limit. Additionally, Portfolio Builder can provide you with a custom ETF portfolio tailored to your needs. With Robinhood Retirement, you can enjoy an easy and rewarding experience when planning for your retirement.

3. Options Trading

Options trading on Robinhood offers access to contracts with no commissions, assignment fees, or per-contract fees. Plus, you can use powerful filters and advanced strategies to optimize your trades. And with multi-leg option strategies, you can easily monitor complex contracts in a single order. For experienced investors looking to take advantage of market opportunities, Robinhood makes it easy to trade options with its intuitive platform. However, options trading is risky, and beginners should approach it cautiously.

Robinhood offers basic and advanced options trading and provides users with various strategies. These include buying and selling calls and puts, spreads, and straddles.

4. Cash Card

With Robinhood's Cash Card, you can get rewarded for your everyday spending! Sign up for a debit card and receive weekly bonuses of up to 10-100% when you use it. You can make up to $10 weekly bonuses and then invest in stocks or crypto. Plus, there are 0 fees or minimum balance requirements.

The Robinhood Cash Card is linked to a user's Robinhood account, allowing them to spend their available cash balance anywhere that Mastercard is accepted.

One of the critical features of the Cash Card is that it provides users instant access to their funds. Users can instantly withdraw money at ATMs or make purchases with their cards without waiting for a transfer from their Robinhood account to their bank account.

The Cash Card also offers cashback rewards on purchases made at selected retailers, which can be easily redeemed into a user's Robinhood account.

Robinhood Cash Card is issued by Sutton Bank and is backed by the Mastercard network. No account fees, foreign transaction fees, or other fees are associated with using the Cash Card.

Robinhood Cash Card provides users instant access to their funds, cashback rewards, and no account fees, making it a convenient and cost-effective option for daily transactions.

5. Robinhood Gold

Robinhood Gold is a premium subscription that provides users access to additional features and benefits unavailable in the standard Robinhood account. These include more extensive instant deposits, which allow users to invest more cash into their account instantly; access to pre-and post-market trading, giving users more opportunities to react to market-moving news; borrowing power, which allows users to increase buying power by borrowing funds from Robinhood with monthly fees for repayment; access to premium research from sources such as Morningstar and NASDAQ; level II market data for real-time data on stocks; and after-hours trading for trading outside of regular market hours.

Robinhood Gold is known for a monthly subscription fee that varies based on a user's tier level.

Three tiers are available – $5/month, $10/month, and $15/month.

Overall, Robinhood Gold provides advanced trading capabilities and additional flexibility for more experienced traders for a monthly subscription fee, making it a valuable option for those looking to take their trading to the next level.

How do you start investing with Robinhood?

Here's how to start investing with Robinhood:

Sign up for a Robinhood account: To begin, you must create an account with Robinhood. You can sign up on the Robinhood website or through the mobile app, which is obtainable on iOS and Android.

Verify your identity: Robinhood is a regulated broker-dealer, which means they must verify all users' identities to comply with anti-money laundering laws. To verify your identity, you must provide personal information, which includes your name, address, and Social Security number.

Fund your account: Once approved, you can finance account by transferring funds or cash from your bank account. Robinhood also supports instant deposits using debit cards. However, there may be some restrictions on the amount you can deposit.

Choose your investments: After your account is funded, you can invest in stocks, ETFs, choices, or cryptocurrencies. Robinhood delivers a wide range of investment options for users to choose from.

Place your trades: To place a business, enter the symbol for the stock or ETF, select the number of shares you want to purchase and choose "buy." You can also place trades for options or cryptocurrencies in the same way.

Monitor your portfolio: Once you've made some investments, you can monitor your portfolio performance on the Robinhood app or website. You can also set up notifications to update you on any news or price changes for your investments.

Robinhood Requirements

You must be 18 years or older.

Must have a valid Social Security number (SSN).

You must have a legal U.S. residential address.

You must have U.S. citizenship, U.S. permanent residency, or a valid U.S. visa.

You must have a valid U.S. bank account with a routing number.

You must have a compatible device to access the Robinhood mobile app, which is available on iOS and Android.

Note that there are also some state-specific requirements for opening a Robinhood account. You can find more information about state requirements on the Robinhood website.

Pros

A great selection of available investments in brokerage accounts, including over a thousand stocks and 16 different cryptocurrencies.

A 1% contribution match on IRAs and Roth IRAs.

An automated portfolio builder in IRAs and Roth IRAs for intuitive and hassle-free investments.

An extensive educational library to help you make better investment decisions.

A free research and financial analysis to help you make informed decisions.

Robinhood does not charge fees for its services, permitting you to trade for free.

Cons

Lackluster investment selection in IRAs and Roth IRAs - with limited options for stocks, bonds, and ETFs

No mutual funds in brokerage or IRAs

No robo-advisor functionality, so you should look into other options if you want hands-off assistance with investing.

Accepts payment for order flow, which could lead to reduced execution quality or higher trading costs.

Are you still unsure if Robinhood is the best option for you?

Don't worry. You have plenty of other options to choose from!

Read on to discover which is best for you and make the most informed decision for your investing needs.

2. Betterment

Betterment provides an easy way to grow your savings and reach your financial goals.

Betterment is a "robo-advisor" micro-investing app that provides automated investment management servicesThis investment platform offers an extensive selection of investment opportunities, such as taxable accounts for individuals and joint account holders, as well as traditional, Roth, and SEP IRAs. Financial experts design better investment strategies, and the platform uses algorithms and technology to manage investors' portfolios. It also offers a high-yield cash management account and a range of educational resources to help investors make informed decisions about their money.

Financial assets you can buy on Betterment include:

Here are several financial assets that you can buy on Betterment, including:

ETFs (Exchange-Traded Funds): Betterment utilizes exchange-traded funds (ETFs) to construct customized diversified portfolios tailored to the investors' specific investment objectives, risk tolerance, and time horizon. ETFs are investment funds that mimic a particular stock index or sector and are traded like individual stocks.

Individual Stocks: Betterment allows investors to buy personal stocks through its platform. This feature is only available to Betterment Premium customers.

Bonds: Betterment offers a range of bond funds from which investors can choose. Bonds are debt securities given by governments or companies that provide investors with a fixed income stream.

REITs (Real Estate Investment Trusts): Betterment offers several REIT funds that invest in various real estate assets. It lets investors invest in real estate without owning physical property.

International Stocks and Bonds: Betterment provides access to international stocks and bonds through its platform. This lets investors diversify their portfolios across different regions and currencies.

Socially Responsible Investing (SRI): Betterment offers SRI portfolio options for investors who want to invest in companies that align with their values. SRI portfolios typically include companies that have a positive social or environmental impact.

How much can you earn with Betterment?

The amount you can earn with Betterment depends on several factors, including the money you invest, your investment strategy, and market conditions. Betterment's historical average returns have been around 5-8% per year after fees, which isn't guaranteed and can vary.

Full disclosure- investing carries risks, including losing money, and historical performance does not indicate future results.

It's also worth noting that Betterment charges a yearly fee of 0.25% to 0.40% of your invested assets, depending on your account size. This fee is calculated and charged monthly.

Furthermore, Betterment's portfolio options and investment strategies are designed for long-term investing, so you should be patient and stick with your plan even when the market experiences fluctuations. The more time passes, the more likely you will be capable of reaching your investment goals.

Pricing:

Betterment's pricing structure is based on the amount you have invested with them. Depending on your account size, they charge an annual fee of 0.25% to 0.40% of assets under management.

Here's a breakdown of the pricing plans:

Digital plan: Betterment's basic plan is its digital plan, which has no minimum account requirement. It charges a yearly fee of 0.25% of assets under management, including access to financial advice via email and in-app messaging.

Premium plan: Betterment's premium plan is offered at a higher fee of 0.40% of assets under management, with a minimum account balance of $100,000. The premium plan offers unlimited access to certified financial planners via phone and email and personalized advice on retirement planning, tax-efficient investment strategies, and other financial planning topics.

Overall, Betterment's fees are competitive compared to traditional financial advisors while offering a streamlined and user-friendly platform for investing. It's also worth noting that Betterment offers a high-yield cash management account called Betterment Cash Reserve, which comes with no fees or minimum balance requirements.

What does Betterment offer?

1. Automated Investment Management

Betterment's Automated investment management service is the core feature of the Betterment platform and is designed to provide investors with an easy and hassle-free way to invest their money. Betterment uses advanced algorithms and technology to create customized client portfolios based on their financial situation, goals, and risk tolerance. The platform automatically rebalances clients' portfolios to maintain their customized asset allocation targets, minimizing risk and maintaining an appropriate level of diversification. Betterment also offers several tax optimization strategies to help investors reduce their tax bill and maximize returns, including tax-loss harvesting. Investors can also set up automatic investments, making saving and investing regularly easy. Betterment's low management fees, which range from 0.25% to 0.40%, depending on the size of the account, make it a cost-effective option for investors looking to build their portfolios over time.

2. Individual and Joint Taxable Accounts

Investors can open individual or joint taxable accounts on Betterment, which allows them to easily invest money, earn returns, and withdraw their money when needed.

3. Betterment Retirement

Betterment offers several retirement account options to help investors save for their golden years.

Here are some details about Betterment's retirement account options:

Traditional IRA: This retirement account allows investors to defer taxes on contributions made to the account until they withdraw the funds during retirement.

Roth IRA: A Roth IRA allows investors to contribute after-tax income to the account and then withdraw tax-free income during retirement.

Simplified Employee Pension (SEP) IRA: This retirement account is designed for small business owners and self-employed people. It permits them to contribute up to 25% of their income or $58,000 (whichever is less) to the account each year.

Rollover IRA: A rollover IRA allows investors to transfer funds from a previous employer-sponsored retirement plan, such as a 401(k), to a traditional or Roth IRA.

Traditional 401(k) and Roth 401(k) options: Betterment also offers both traditional and Roth 401(k) options to help investors save for retirement through their employers.

Betterment provides investment management services to help investors reach their retirement savings goals. Through its retirement account options, investors can take advantage of tax benefits and flexible contribution limits while investing in Betterment's diversified ETF portfolios. Additionally, Betterment's Premium plan offers access to certified financial planners who can provide personalized guidance on retirement planning topics such as Social Security, tax optimization strategies, and more.

4. High-Yield Cash Management Account

The Betterment High-Yield Cash Management Account is an online savings account offering a high interest rate. It has no minimum balance limitations or monthly maintenance fees, so this account is a convenient and low-cost way to save money. The account also provides FDIC insurance up to $1 million, which means your money is safeguarded. Moreover, Betterment's investment platform seamlessly integrates with the account, making managing your investments and savings easy. Additionally, the account allows unlimited withdrawals and transfers, providing flexibility while saving. Overall, the Betterment High-Yield Cash Management Account is an excellent choice for earning competitive interest rates on your savings without hassle.

5. Socially Responsible Investing (SRI) Portfolio Options

Betterment offers Socially Responsible Investing (SRI) portfolio options for investors who want to invest in companies that align with their values. These portfolios focus on companies in specific industries, such as sustainable agriculture, alternative energy, and conservation. Betterment uses a screening process to identify companies that meet its SRI criteria, which include Environmental, Social, and Governance (ESG) factors. Betterment's SRI portfolios are diversified across multiple asset classes and geographies to minimize risk while making a positive social or environmental impact. The company's goal through its offering of SRI portfolios is to provide investors with opportunities to invest in businesses and industries that align with their values and social impact goals.

6. Personalized Financial Advice

Betterment offers personalized financial advice to its premium users through Certified Financial Planners (CFPs), who provide one-on-one guidance to help users achieve specific financial goals.

7. Financial Education Resources

Betterment provides financial education resources to empower individuals to make informed decisions regarding managing their money. These resources are free to use and cover various topics, such as investing basics, retirement planning, and socially responsible investing. These resources take several forms, including articles, guides, videos, blogs, webinars, and workshops, all of which are easily accessible and have been created to be easily understandable. Betterment's financial advisors are on hand to provide personalized advice backed up by a wealth of knowledge and experience. Overall, Betterment's financial education resources offer valuable insights into personal Finance and are an excellent place to start for anyone looking to learn more about managing their finances.

How to start investing with Betterment?

Here's how to start investing with Betterment:

Create an account: Visit Betterment's website and create an account. You will be prompted to provide personal information like your name, email address, and password.

Set up your investment account: Once you've created your account, you must select the type of investment account you want to open. Betterment offers individual and joint investment accounts, traditional and Roth IRAs, and SEP IRAs.

Define your investment goals: After selecting an investment account, you'll need to define your investment goals or objectives, such as saving for retirement, a down payment on a home, or a child's education. This will help Betterment understand your investment needs and risk tolerance.

Choose a portfolio: Based on your investment objectives and risk tolerance, Betterment will recommend an investment portfolio that's right for you. You can also choose from various other portfolios that fit your investment needs.

Fund your account: Once you've chosen your portfolio, you'll need to fund your account. You can transfer funds from your previous investment or bank accounts or set up recurring deposits.

Monitor your investments: Betterment will take care of the rest, monitoring and rebalancing your portfolio as needed. You can also monitor your investments and progress toward your goals through Betterment's website or mobile app.

Who is eligible to use Betterment?

Betterment is available for use to individual investors who are residents of the United States, including the District of Columbia and all 50 states, who meet the following eligibility criteria:

Individuals must be at least 18 to open an account with Betterment.

Joint accounts are available for couples who are either married or in a registered household partnership.

Investors must have a valid bank account to fund their Betterment investment account.

Betterment is best suited for individuals looking to invest for a future goal or objective, such as retirement savings, a down payment on a child's education, or a house.

There is no minimum account balance needed to open an account with Betterment. However, some portfolio options, such as the Betterment Premium plan, have a minimum balance requirement.

Betterment charges a management fee, ranging from 0.25% to 0.40% of assets under management, depending on the account type and balance.

Pros

Manage your investments without doing the heavy lifting yourself.

Your portfolio is automatically diversified to help minimize risk and maximize returns.

Get access to low-cost investments without sacrificing quality.

No minimum account balance is required for checking and digital investing accounts, allowing you to start investing with a small amount of money.

Quickly liquidate your investments and withdraw your funds within 4 to 5 days.

Sync all your external accounts to get an in-depth overview of your finances from a single, easy-to-navigate dashboard.

Cons

Pay more in account fees than you would with more traditional investments.

They have fewer choices when it comes to investments.

Financial guidance services come with a high price tag, commencing at $199 for a single 45-minute consultation.

Users can sync a limited number of external accounts, limiting the data they can use to make informed decisions.

3. Linqto

Linqto is a platform that enables accredited investors to access and invest in private market opportunities. The private market is an area of the investment landscape that includes privately held companies, private equity firms, and other alternative investment vehicles.

Linqto provides a technology platform that simplifies the process of investing in personal market opportunities, offering investors a secure and streamlined way to connect with vetted companies and investment opportunities. Through its platform, Linqto enables accredited investors to participate in private offerings, startup investing, and alternative investments, providing access to a range of assets and investment strategies previously only available to institutional investors.

Linqto's platform utilizes modern technology, such as blockchain and artificial intelligence, to enable faster decision-making, greater transparency, and increased liquidity in the private market. By providing access to previously inaccessible personal market opportunities, Linqto helps democratize investing and can offer the potential for attractive returns to a wide range of investors.

Financial assets you can buy on Linqto include:

Linqto enables accredited investors to buy financial assets in private market opportunities, including:

Private Equity: Linqto offers access to various private equity investments, such as early-stage startups, growth companies, and established businesses.

Alternative Investments: Linqto provides entry to diverse investment opportunities, encompassing real estate investment trusts (REITs), hedge funds, and commodities.

Private Offerings: Private offerings provide access to companies not publicly traded on stock markets. With Linqto, accredited investors can access these private offerings and invest in various industries.

Secondary Market Opportunities: Linqto provides access to secondary market opportunities, allowing investors to buy and sell securities in the private market.

Tokenized Assets: Linqto is at the forefront of the security token industry and provides access to tokenized assets. These assets are blockchain-based digital tokens representing ownership in private companies, funds, or other investment vehicles.

Linqto offers a diverse range of financial assets to accredited investors who previously were only available to institutional investors. Its digital investment platform has transformed how investors access and invest in the

How much can you earn with Linqto?

Linqto facilitates private market investment opportunities, and the potential earnings for investors on Linqto can vary based on factors like the type of investment, the investment's performance, and market conditions at the time of sale. Therefore, it isn't easy to provide a specific earnings estimate. However, Linqto aims to provide investors with access to investment opportunities with varying levels of risk and potential returns.

What does Linqto offer?

Linqto offers accredited investors investment opportunities in the private markets. The platform grants entry to diverse investment possibilities encompassing venture capital, private equity, and hedge funds. Linqto aims to provide investors with high-quality investment opportunities previously only known to institutional investors.

The forum provides investors with a range of resources and tools to assist in making well-informed investment decisions. These resources comprise market analysis and insights, tools for visualizing data, and access to a network of experts and investors, facilitating connections for investors.

In addition, Linqto offers a streamlined investment process that helps investors access investment opportunities quickly and easily. Investors can also monitor their investments through the platform and have access to reporting and analytics tools.

Overall, Linqto aims to democratize access to private market investments and help accredited investors diversify their portfolios and potentially earn higher returns. However, investors should remember that all investments come with risks and carefully consider their financial goals, risk tolerance, and due diligence before investing.

How do you start investing with Linqto?

To start investing with Linqto, you need to follow these steps:

Meet Accreditation Requirements: Linqto is a platform that only accepts investments from accredited investors. Therefore, you must ensure that you meet the requirements for accreditation as per SEC guidelines.

Create a Linqto Account: You can create an account on Linqto's platform. You must provide information such as your name, contact information, and verification of your accredited investor status.

Browse Offerings: Once your account is verified, you can carefully browse the various investment offerings on the platform. Linqto provides detailed information about each investment opportunity, and you can review the investment's data in-depth. If you need help evaluating investment opportunities, you can contact Linqto's community of experts and other investors.

Choose an Investment: After evaluating several investment opportunities, you can select the one or multiple investments that best fit your financial objectives and risk tolerance.

Complete Subscription Documents: To invest in an offering, you must complete subscription documents, such as a subscription agreement, payment instructions, and any disclosures. The documents you need to complete may vary based on the investment opportunity you choose.

Fund Your Account: Once you have completed the subscription documents, you must transfer funds into your Linqto account, which is an investor in the offering.

Monitor your Investments: After investing in an offering, you can monitor your investments through Linqto's platform. You can monitor the investment's performance, access reporting and analytics tools, and communicate with the investment manager, investors, and the issuer.

Who is eligible to use Linqto?

To be eligible to use Linqto's platform, individuals must meet at least one of the following criteria:

A prerequisite for eligibility is possessing a net worth of no less than $1 million, except the cost of their principal place of residence.

They must have an income of at least $200,000 in the past two years or at least $300,000 in joint revenue with their spouse in the same period and have reasonable expectations of the same income level in the current year.

In addition, certain entities like banks, investment companies, and charities with assets exceeding $5 million may also qualify as accredited investors.

Therefore, to be eligible to use Linqto's platform, investors must meet the accreditation requirements set by the SEC.

Pros

Linqto provides accredited investors access to private market investment opportunities, which can offer diversification benefits and potentially higher returns.

Linqto offers diverse investment opportunities across different industries, stages, and geographies, enabling investors to build diversified portfolios tailored to their investment goals.

Linqto offers a streamlined investment process that allows investors to easily access and purchase investment offerings online without needing physical intervention.

Linqto offers access to a community of expert investors and advisers. With access to valuable insights and feedback from others, investors can make informed decisions.

Linqto's platform is accessible on mobile devices, allowing investors to monitor and manage their investments from anywhere.

Cons

Linqto only accepts investments from accredited investors, making the platform inaccessible to most small investors.

All investments come with risks, and private market investments can be inherently riskier due to the nature of the asset class. Investors should perform due diligence and carefully evaluate risks before investing.

Private market investments may have limited liquidity, which means that investors may need more time to sell their investments and may face delays in obtaining returns or accessing their capital.

Investors in private market investments often pay higher fees than publicly traded alternatives.

Investments in private markets may be uncertain and can fluctuate widely in value. Investors must have sound risk tolerance and financial planning to manage potential losses.

4. M1 Finance

M1 Finance is an online brokerage and monetary services platform that allows users to invest money in a customizable portfolio of stocks and funds. It provides various investment tools, such as an expert-curated portfolio, automated investment management, and flexible investing options. One of the amazing features of M1 Finance is that it allows investors to buy fractional shares in their desired stocks or funds, which helps to create a diversified portfolio even with smaller amounts of money. M1 Finance provides more than just investing services. Among its offerings are cash management tools such as a checking account, a debit card, and a savings account with a high yield. The platform is known for its low fees, commission-free trading, and hassle-free user experience.

Financial assets you can buy on M1 Finance include:

Here are some financial assets that you can buy on M1 Finance:

Individual stocks: You can buy and sell individual stocks of companies listed on major US stock exchanges like Nasdaq, NYSE, and BATS.

Exchange-traded funds (ETFs): M1 Finance offers a wide range of ETFs that can be used to build a diversified portfolio across multiple sectors and asset classes.

Expert Pies: M1 Finance offers pre-made ETF portfolios based on risk level and investment goals. These portfolios are called "Expert Pies" and are curated by M1 Finance's investment team.

Custom Pies: You can also create your portfolio of stocks and ETFs, which M1 Finance calls "Custom Pies." You can choose your target allocation by percentage, and M1 will automatically manage your portfolio to keep it balanced.

Fractional shares: M1 Finance is one of the few brokerage platforms that allows you to buy fractional shares of stocks and ETFs. This means you can invest in stocks that would be too expensive to buy as a whole share.

How much can you make with M1 Finance?

Earnings on M1 Finance depend on the investments made by users and the overall market's performance. M1 Finance provides investment tools and services, allowing investors to build a diversified portfolio depending on risk tolerance and investment objectives. The returns on investment in the financial market can vary based on many factors, including macroeconomic factors, the performance of individual companies involved in an investment portfolio, and other market influences.

It is important to remember that investing always involves a certain level of risk, and no investment is guaranteed to earn a profit. The amount you can earn with M1 Finance varies widely depending on the individual investments made, the investing strategy, and the overall economic environment. M1 Finance makes no predictions or guarantees regarding future investment performance or earnings. As such, it is always advisable to thoroughly research all investment options and consider your financial situation before making any investment decisions.

What does M1 Finance offer?

1. Investing with Pies

M1 Finance's "Pies" system allows you to create customized investment portfolios using a simple drag-and-drop interface. You can choose from hundreds of individual stocks and ETFs or pre-built portfolios created by M1 Finance.

Here's how it works:

When you log into M1 Finance, you'll see the dashboard with the "pie" feature. You can create a pie and choose from various stocks, ETFs, and other securities to include in your pie. Each slice of your pie represents additional security, and you can adjust the percentage of your investment allocated to each slice.

M1 Finance also offers pre-built pies that typically include a mix of multiple asset classes, such as stocks, bonds, and ETFs. They offer expert-curated portfolios for different goals, such as building wealth or generating income.

Once you've created or selected a pie, M1 Finance automatically invests your money according to your chosen allocation. If you want to make changes, you can adjust your pie anytime.

2. Fractional Investing

M1 Finance allows you to buy and sell fractional shares of stocks and ETFs. This means you don't need enough money to buy a whole share and can invest in any company you choose, regardless of the price per share.

3. Retirement Accounts

M1 Finance offers several retirement account options for its users, including Traditional IRAs, Roth IRAs, SEP IRAs, and Rollover IRAs.

Here's a brief overview of each retirement account type:

Traditional IRA: By opening a Traditional IRA account, you can put aside funds for your retirement and postpone paying taxes on the contributions until you withdraw them during your retirement years. You can start withdrawing from Traditional IRA penalty-free starting at age 59 1/2.

Roth IRA: A Roth IRA allows you to contribute after-tax dollars and withdraw your funds tax-free in retirement. You can start withdrawing your funds tax-free at age 59 1/2.

SEP IRA: A SEP IRA is a Simplified Employee Pension IRA that self-employed individuals or small business owners can use to provide retirement benefits for themselves and their employees. Contributions are tax-deductible and tax-deferred, and contributions can be made until you file your taxes (including extensions).

Rollover IRA: A Rollover IRA allows you to transfer existing retirement account funds from a 401(k), 403(b), or another retirement account into an IRA. This can be useful if you change jobs or retire and desire to consolidate your retirement accounts.

M1 Finance's retirement accounts have no fees and offer access to various investment options, including individual stocks, ETFs, and mutual funds. Additionally, M1 Finance's automated rebalancing feature helps ensure that your retirement portfolio stays aligned with your investment goals and risk tolerance over time.

4. M1 Borrow

M1 Borrow is a feature of M1 Finance that lets users borrow money using their investment portfolios as collateral. The interest rates on M1 Borrow loans are low compared to other forms of debt, making it an attractive option for many users. Users can refund the loan at any time without any prepayment penalties. M1 Borrow loans are non-recourse, meaning that if the borrower can't repay the loan, M1 Finance can only go after the collateral (investment portfolio) and not any other assets of the borrower.

M1 Finance offers flexible repayment terms so users can repay the loan for one to five years. Users have the option to set up automatic payments to ensure the timely repayment of the loan. M1 Borrow is only available to M1 Finance users with a taxable investment account with a minimum balance of $10,000. Users can use the borrowed funds for any purpose, including paying off high-interest debt, making a large purchase, or covering unexpected expenses.

5. M1 Spend

M1 Finance offers a checking account option called M1 Spend, which is linked to your M1 Finance investment account.

Here are some of the features of M1 Spend:

No fees: There are no monthly maintenance, overdraft fees, or minimum balance requirements.

ATM fee reimbursement: M1 Finance will reimburse up to five monthly ATM fees.

High APY: M1 Spend offers a high APY on your deposit balances.

Bill pay: You can set up payments directly from your M1 Spend account.

Direct deposits: You can deposit your paycheck or other funds directly into your M1 Spend account.

FDIC-insured: M1 Spend accounts are FDIC-insured up to $250,000, so you can be sure your money is safe.

M1 Spend allows you to manage your cash flow and pay bills directly from your M1 Finance account, so you don't have to transfer money back and forth between accounts. It's a convenient option for users who want to keep their financial accounts in one place. If you sign up for M1 Plus, you can receive additional benefits on your M1 Spend account, such as a higher APY on your deposit balances, cashback rewards, and more.

6. Credit Card

M1 Finance also offers a credit card to earn cash back on purchases. You can redeem your rewards for money or use them to pay down your M1 Borrow balance.

7. M1 Plus

M1 Plus is a premium account that provides additional benefits to M1 Finance users. It offers higher APY rates on cash balances, a second trading window, a lower interest rate on M1 Borrow, and more.

M1 Plus membership benefits:

Higher APY (Annual Percentage Yield) on cash balances compared to the basic M1 membership.

Rewards program: members can earn rewards using the M1 Plus debit card on qualified purchases.

Low interest rates on margin loans compared to non-members.

Access to a second trading window gives users more control and flexibility over their investments.

Smart transfers with multiple automation options to help move money between different accounts quickly.

Discounts on M1 Borrow rates that M1 Plus members can avail of.

Cashback rewards on qualified debit card purchases.

Advanced portfolio insights help users make more informed decisions about their investments.

Exclusive access to educational content and events that can help improve your investment knowledge and skills.

Dedicated customer support with a phone line and email queue for swift resolution of any issues and queries.

How to start investing with M1 Finance?

Here are the steps to start investing with M1 Finance:

To open an account, visit the M1 Finance website and click the "Sign Up" button. Type your email address, password, and basic information to create an account.

Choose an account type: Select what type of account you want to open - individual, joint, trust, or retirement account.

Fund your account: Merge your bank account to your M1 Finance account to transfer funds. The minimum deposit to start investing with M1 Finance is $100.

Create your portfolio: Create a customized investment portfolio by choosing from various stocks and ETFs available on the platform. You can also choose from pre-made " Pies " portfolios designed to meet specific investment objectives.

Set up automated investing: M1 Finance offers an "Auto Invest" feature that automatically allows users to set up recurring investments. Choose the amount you want and how often you wish to invest.

Monitor your portfolio: Keep track of your portfolio's performance on the M1 Finance website or mobile app. You can change your portfolio anytime, such as adding or removing investments.

Following these steps, you can initiate investing with M1 Finance and build a customized portfolio that meets your financial goals. M1 Finance aims to make investing easy and accessible to all investors, from beginners to experienced traders.

Who is eligible to use M1 Finance?

To be eligible to use M1 Finance, you must meet these requirements:

Must be at least 18 years old

A person must have a valid Social Security number (SSN)

A person must be a U.S. citizen or resident alien with a valid U.S. address

Must have a U.S. bank account for funding and withdrawals.

Additionally, to use certain features of M1 Finance, such as M1 Borrow, you must have a minimum balance of $10,000 in your taxable investment account.

Pros

M1 Finance offers a unique hybrid model that combines robo-advisory with self-directed investing. This means you can choose from expert-built portfolios or customize your own.

Those who subscribe to the M1 Plus program can enjoy great perks such as cashback rewards and higher APY on cash balances.

M1 Finance is a commission-free trading platform. You can trade stocks and ETFs without incurring trading fees in your account.

M1 Finance allows users to build a custom portfolio tailored to their investment goals or choose from over 60 expert portfolios within different market niches.

M1 Finance's dashboard allows you to view and manage your portfolio quickly.

M1 Finance is a member of SIPC, which insures cash and securities in the account up to $250,000 in cash and $500,000 in total.

Cons

M1 Finance does not offer mutual funds. This means investors looking to invest in mutual funds will have to look elsewhere.

You can only make trades once daily with the primary account tier and twice daily with the M1 Plus tier. This can be a disadvantage if you need to make trades more frequently.

While the M1 Plus membership has attractive perks, such as cashback rewards and higher APY, it comes at $125 per year, which may not make sense for all investors.

5. Firstrade

Firstrade is an online investment platform that offers commission-free stock and ETF trading, options trading, mutual fund trading, and retirement account trading. The platform was founded in 1985 and is headquartered in California, USA. One of the unique features of Firstrade is that it lets users trade stocks and ETFs in 13 different global markets, including the United States, China, Japan, and Hong Kong.

Firstrade offers various educational resources to help users make informed investment decisions. The platform provides market analysis, stock news, and real-time price quotes, among other tools. It also has a mobile app that helps users manage their investments.

The platform is best suited for investors of all levels looking for a comprehensive trading platform, international exposure, and low trading costs. With the addition of options trading and mutual fund trading, Firsttrade has expanded its offerings to offer more investment choices to its users.

Financial assets you can buy on Firstrade include:

Firstrade offers a variety of financial assets that users can buy and sell on its platform.

Here are some of the investment products available on Firstrade:

Stocks: Firstrade offers commission-free trading for stocks listed on U.S. stock exchanges and those listed on various international businesses.

ETFs: Much like stocks, Firstrade offers commission-free trading on a wide range of ETFs, including iShares and Vanguard.

Options: Firstrade allows users to trade options contracts, including single-leg options, multi-leg options, and covered calls.

Mutual Funds: Firstrade offers over 11,000 mutual funds, including no-load and load funds, with access to comprehensive research tools and an advanced mutual fund screener.

Bonds: Firstrade customers can buy and sell fixed-income securities such as U.S. Treasuries or corporate bonds.

Futures: Firstrade allows users to trade futures contracts for commodities, indices, and currencies.

Foreign Currency: Firstrade allows users to convert and trade currencies through their accounts.

How much can you earn with Firstrade?

The money you can earn with Firstrade depends on various factors, such as your investment products and the amount you invest. Several investment ways include capital appreciation, dividend income, interest income, and capital gains. However, the amount you can earn from these sources will vary based on market conditions and individual investment choices. As with any investment, there is no assurance of profits, and investors should be aware of the potential risks involved.

Therefore, investing in a balanced portfolio that caters to your financial goals and needs is essential, and carefully and diligently monitoring your portfolio's performance regularly is essential. While Firstrade offers diverse investment options to help you earn income, it's vital to research, examine your financial situation, and consult with a financial professional before making any investment decisions.

Regenerate response

What does Firstrade offer?

1. Commission-Free Trading

Firstrade offers commission-free trading on stocks and ETFs, so users can trade without incurring trading fees, which can significantly lower their trading costs.

2. Investment Education and Research Tools

Firstrade offers extensive research tools to help users make informed investment decisions. These include company research reports, market news and analysis, and educational materials like webinars and articles.

3. Multiple Account Types

Firstrade offers various account types to suit investor needs, including individual, joint, and retirement accounts. They also offer business accounts and custodial accounts for minor children.

4. International Trading

Firstrade provides users access to global markets, including 13 international stock exchanges like China, Japan, and Hong Kong, to trade in those respective markets.

5. Mobile Trading

Firstrade presents a mobile app for iOS and Android devices that allows users to manage their accounts, trade, and access research tools. Investors can use this app to buy, sell, and track their stock portfolios while on the move.

6. Fixed-Income Securities and Mutual Funds

Firstrade allows investors to buy and sell a wide range of fixed-income securities like bonds, Treasury, CDs, and more than 11,000 mutual funds.

7. Advanced Trading Tools

Firstrade offers advanced trading tools such as options trading, which provides the ability to trade options, and bond ladders, which are used to build a diversified portfolio of bonds. Mutual fund screeners help investors identify and analyze mutual funds.

8. Firstrade Retirement

Firstrade offers a range of retirement account options, including Traditional IRA, Roth IRA, SEP IRA, Solo 401(k), and SIMPLE IRA. These accounts come with $0 commission fees on online trades for stocks, ETFs, and options. Firstrade also offers a wide selection of commission-free mutual funds and no-transaction-fee (NTF) mutual funds, which can provide a diversified investment portfolio for retirement savings.

Additionally, Firstrade's retirement accounts offer tax advantages to help you save more for retirement. For instance, donations to a Traditional IRA may be tax-deductible, and earnings on investments in an IRA account grow tax-free until withdrawn. While making contributions to a Roth IRA does not provide a tax deduction, any qualified distributions will be exempt from taxation.

How to start investing with Firstrade?

Here are the steps to start investing with Firstrade:

Open an Account: You must create a Firstrade account by providing basic personal and financial information. You can begin the application process online, which usually takes a few minutes.

Fund Your Account: Once your account is open, you can fund it through electronic bank transfer or wire transfer. You can also transfer your existing retirement account(s) to Firstrade.

Choose Your Investment: After you have funded your account, you can start investing by choosing securities like stocks, mutual funds, ETFs, and other investment options on the Firstrade trading platform. Use Firstrade's research tools and educational resources to make informed investment decisions.

Place an Order: Once you have selected your investment, you can order securities through the Firstrade platform. You can buy, sell, or trade securities based on your investment objectives.

Who is eligible to use Firstrade?

Firstrade is available to U.S. citizens and legal residents with a correct Social Security number. To open a brokerage account with Firstrade, you must be 18 and meet the minimum opening requirements. Additionally, Firstrade requires that you have a valid U.S. address and phone number.

Remember that certain account types, such as an IRA, have specific eligibility requirements beyond the minimum account opening requirements. For example, to contribute to a Traditional IRA, you must have gained income and meet income limits, while Roth IRA contribution limits are based on income.

Pros

Firstrade offers commission-free trading on stocks, ETFs, mutual funds, and options, which can help investors save money on trading fees.

Firstrade provides various research tools to help investors make informed investment decisions. These research tools include headlines from leading financial sources, market data, independent research reports, and access to fundamental and technical analysis.

Firstrade offers educational resources to help investors learn more about investing. These resources include educational videos, webinars, and articles on various topics, such as investing basics, risk management, and retirement planning.

Cons

Firstrade only supports bank transfers for depositing funds into your account, which can be inconvenient for some investors who prefer to use debit/credit cards or e-wallets.

Firstrade only allows trading on U.S. markets, which could limit investment opportunities for investors looking to diversify their portfolio with international investments.

Firstrade's customer support is unavailable 24/7, and the brokerage does not offer a live chat feature.

6. LendingClub

LendingClub is an online peer-to-peer lending (P2P) platform that connects borrowers seeking personal loans with investors looking to invest funds. The forum operates by matching borrowers with investors, who then directly offer loans to the borrowers. LendingClub's online platform streamlines the loan process and simplifies the borrowing experience by providing easy access to personal loans at competitive rates.

LendingClub uses a proprietary program to assess borrowers' creditworthiness and assigns a credit grade and interest rate based on their credit history, income, debt-to-income ratio, and employment history. On the other hand, investors can view borrowers' profiles and select the loans they want to fund based on credit grade, loan size, and other factors.

Financial assets you can buy on LendingClub include:

LendingClub allows investors to purchase notes representing fractional ownership in unsecured consumer loans issued to borrowers by LendingClub.

Here are the financial assets you can buy on LendingClub:

LendingClub Notes: These fractional loans represent a small slice of a borrower's loan. Investors buy these notes in increments of $25 to build a diversified investment portfolio.

LendingClub Certificates: These securities are backed by collections of LendingClub Notes. LendingClub Certificates represent a more stable investment option, offering a fixed interest rate and payment stream.

Automated Investing: Investors can use LendingClub's automated investing feature to create a customized investment portfolio using a combination of LendingClub Notes and Certificates.

How much can you earn with LendingClub?

The money you can earn with LendingClub depends on several factors, including the amount of money you invest, the interest rates of the loans you invest in, the performance of the borrower's loans, and the fees charged by LendingClub.

LendingClub exposes investors to personal loans with fixed interest rates and payments. The interest rates on these sorts of loans vary depending on the creditworthiness of the borrowers, which are rated based on their credit history, income, debt-to-income ratio, and other factors.

Historically, the average net annualized return for LendingClub investors has been between 4% and 8%. However, it is essential to remember that earnings are not guaranteed, and borrowers are always likely to default on their loans.

It's important to note that LendingClub charges investors service fees and deducts fees from the interest payments received from borrowers. Investors should account for these fees when estimating their potential earnings.

Ultimately, The potential earnings from investing in LendingClub are determined by factors such as your investment approach, level of risk tolerance, and individual circumstances. It's always advisable to confer with a financial advisor before making any investments and to closely track the performance of your investment over time.

What does LendingClub offer?

LendingClub offers a peer-to-peer (P2P) lending platform that connects borrowers seeking personal loans with investors who want to finance these loans.

Here's a breakdown of what LendingClub offers:

1. Personal Loans:

Borrowers can apply online and receive funds before the next business day. LendingClub delivers personal loans ranging from $1,000 to $40,000, with fixed rates and payment terms ranging from 36 to 60 months.

2. Investment Opportunities:

Investors can purchase notes representing fractional ownership in unsecured consumer loans issued to borrowers by LendingClub. They can select loans they want to fund based on credit grade, loan size, and other factors and build a diversified investment portfolio.

3. Loan Options:

LendingClub provides loan options to borrowers with different credit scores, from excellent to fair credit. Borrowers are assigned a credit grade and interest rate based on their creditworthiness, income, debt-to-income ratio, and employment history.

4. Streamlined Process:

LendingClub's online platform streamlines the lending process by providing borrowers with easy access to personal loans at competitive rates. Additionally, investors can view the profiles of borrowers and select loans they want to fund.

5. Educational Resources:

LendingClub offers educational resources to help borrowers and investors make informed decisions. These resources include articles, tips, and tools on personal Finance, credit score improvement, investing, and more.

6. LendingClub institutional investing:

LendingClub institutional investing refers to investment opportunities for institutional investors on LendingClub's peer-to-peer lending platform. Institutional investing in LendingClub aims to offer institutional investors access to a diversified investment option in consumer credit with high returns, low correlation with other assets, and lower fees than traditional asset classes.

Institutional investors can purchase whole loans and create custom portfolios by selecting loans based on credit grade or using automatic investing to receive a blend of loans. To invest in LendingClub, institutional investors should have a minimum investment of $1 million, be registered, and have access to LendingClub's suite of APIs and data files.

How to start investing with LendingClub?

Create an account with LendingClub: To create an account, go to the LendingClub website and click on the "Investing" tab. Then click the "Get Started" button and complete the required information to create your account. You must conduct an identity verification procedure as part of the registration process. This will entail providing personal data and answering questions to verify your identity.

Transfer funds into your LendingClub account: Once you have created your account and completed the identity verification process, you can transfer funds into your LendingClub account. You can do this electronically from your bank account or by mailing a check.

Decide how much you wish to invest in each loan and set up automated investing criteria: LendingClub offers an "automated investing" feature, which lets you automatically invest in loans that meet your specific criteria. To set this up, you'll need to decide how much you wish to invest in each loan and what types of loans you want (e.g., debt consolidation, home improvement, or small business). You can also set other criteria, such as the borrower's credit score range or how much the loan is already funded.

LendingClub will then match you with loans that meet your specific criteria. Once you have set up your automated investing criteria, LendingClub will check you with loans that meet your specific requirements. You can also manually browse and invest in individual loans if you prefer.

Monitor and manage your investments through your LendingClub account dashboard: LendingClub provides a dashboard to monitor your investments and see how they perform. You can also reinvest your earnings or withdraw them as cash. LendingClub charges a small fee (1% of the amount invested) for its investment services.

Who is eligible to use LendingClub?

To be eligible to use LendingClub, you must meet the following requirements:

You must be at least 18 years old.

An individual must be a resident of the United States.

A person must have a valid Social Security number.

You must have a verifiable bank account.

Pros

With LendingClub, you can invest in multiple loans with relatively small amounts of money, which can help to spread out your risk.

Investing in LendingClub can potentially yield higher returns compared to low-risk options like savings accounts, but it's important to note that there are still risks involved.

LendingClub's user-friendly interface makes it easy to find and invest in loans.

LendingClub offers an automated investment option that can save investors time and effort.

Cons

LendingClub loans are not guaranteed, and there is always the risk that loans may default, which could result in a loss of investment.

LendingClub charges a fee for its investment services, which can affect your returns over time.

Investments made through LendingClub are not easily liquidated, meaning you may be unable to access your funds quickly if needed.

LendingClub is not available to everyone, as investors must be U.S. residents with a valid Social Security number and a verifiable account.

LendingClub's operations are subject to regulation, which could change and impact the platform's viability in the future.

7. Red Lion Capital

Red Lion Capital is a customer-centric investment firm that values its clients above all else. The firm was founded to make quality equity investments more accessible to investors.

Red Lion Capital seeks to understand its clients' goals and provide differentiated investment opportunities that add value and grow over time and economic cycles. The company focuses on creating value for its clients and investors through a diversified approach that is managed in-house and across multiple platforms.

Overall, Red Lion Capital's approach prioritizes its clients' success and strives to develop long-term relationships with its investors by delivering quality investment opportunities and managing them effectively. While conducting further research and due diligence on any investment firm or opportunity is essential, Red Lion Capital's approach may appeal to investors seeking a client-focused investment experience.

How much can you earn with Red Lion Capital?

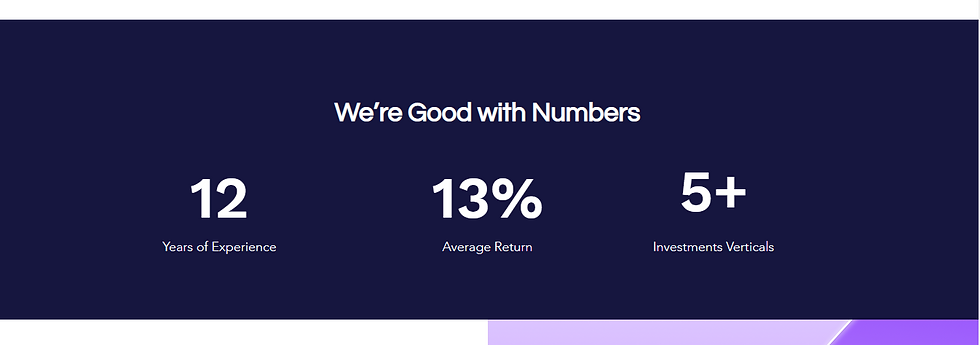

With over 12 years of experience in the industry and a team of experienced professionals, Red Lion Capital is committed to providing investors with superior returns. The firm offers a variety of investment chances, including stocks, bonds, commodities, and more. One of their strengths is their knowledge of non-traditional investment options, including private equity, venture capital, and real estate. Red Lion Capital's portfolio is diversified across multiple asset classes, and its team of professionals is committed to delivering a high level of personalized service to ensure that investors get the best returns possible.

Red Lion Capital has achieved impressive results over the years, with an average return of 13%, and they have continued to expand their offerings. With investments in over five sectors, including real estate, venture capital, private equity, and more, they provide a broad range of possibilities to meet any investor's needs.

What does Red Lion Capital offer?

Red Lion Capital offers the following:

Investment Strategies: Red Lion Capital offers a range of investment strategies backed by thorough research. These strategies are designed to help their clients achieve their investment goals. They carefully evaluate various investment options and tailor their strategies to meet individual needs.

Diversification: A diversified growth portfolio helps clients spread their investments across different industries, asset classes, and geographies. This helps to reduce the portfolio's overall risk while maintaining a good potential for growth.

Value Optimization: Red Lion Capital aims to create a transformational impact with its investments. They focus on investments that provide financial returns to their clients and make positive social and environmental impacts. They carefully select investments that align with their clients' values and contribute to a sustainable future.

Overall, Red Lion Capital offers a comprehensive investment approach that integrates research, diversification, and social impact to help clients achieve their investment goals.

How to start investing with Red Lion Capital?

To start investing with Red Lion Capital, you will need to follow these steps:

Contact Red Lion Capital: To begin the investment process, contact Red Lion Capital through their website, phone number, or email. A representative will guide you through the process of opening an investment account.

Determine Your Investment Goals: Before opening an investment account with Red Lion Capital, you should determine your investment goals. This will help you choose the right investment strategy for you.

Choose an Investment Strategy: Red Lion Capital provides customized solutions for distinct investment objectives. Relying on your investment goals, you can select the portfolio that aligns with your requirements.

Open an Investment Account: Once you have determined your investment goals and chosen an investment strategy, you can open an investment account with Red Lion Capital. You will need to provide personal information and complete the necessary paperwork.

Make Your First Investment: After establishing your account, you can invest with Red Lion Capital. Their team will help you to choose the appropriate investment options and manage your investment portfolio over time based on your investment goals.

Final Word

In conclusion, choosing the right micro-investing app can significantly impact your ability to reach your investment and savings goals. By considering factors such as your investment objectives, fees, investment options, ease of use, security, and reviews, you can identify the best app for you. Once you've found a micro-investing app that fits your needs, monitoring and managing your investments regularly ensures they align with your goals. Remember that investing always carries some risk, regardless of your chosen app. Hence, it's critical to understand your investment choices and how they may align with your investment goals. Discover the seven amazing micro-investing apps I've mentioned and select the one that works best for you. Explore their features and start investing today.

![The Ultimate Guide to Selling on Craigslist Safely [Reviewed]](https://static.wixstatic.com/media/e17a16_e9272a9222174d42b860b934d0b7d1c9~mv2.png/v1/fill/w_980,h_551,al_c,q_90,usm_0.66_1.00_0.01,enc_avif,quality_auto/e17a16_e9272a9222174d42b860b934d0b7d1c9~mv2.png)

Comments