How to Start Real Estate Investing (Beginner Guide)

- webymoneycom

- Dec 3, 2023

- 13 min read

Updated: Dec 23, 2024

Have you been thinking of becoming a Real Estate Investor?

If you answer yes, 2025 is the best time to invest in real estate!

With the market shifting, now is the time to take advantage of the chance to build a portfolio that will yield long-term returns. As a novice, investing in real estate can feel overwhelming and intimidating. But, with the correct information and support, anyone can become a successful real estate investor.

Many people are searching for a passive way to generate income, and real estate investing is a popular option.

The need for rental properties is projected to continue to increase. So, if you're wondering how to get into real estate investing, you're not alone. But before you choose to take this route, there are vital questions you need to ask yourself.

Are you prepared for the threats associated with investing in real estate?

Ensure to consider all aspects before making your decision.

This blog will cover the basics of real estate investing and provide tips, tricks, and strategies necessary to grow your portfolio and generate returns.

So don't wait any longer - let's begin your journey to becoming a real estate investor!

Is Real Estate a Good Investment?

For many reasons, real estate has remained a dependable and lucrative investment choice for years. Unlike the fluctuating stock market, it's a concrete and tangible investment that can offer consistent and trustworthy returns.

Real estate investments seem appealing but may not be optimal if your financial status is uncertain. With the down payment, closing costs, and potential repairs that come with any real estate investment, it is good to wait until you are in a stronger financial position before taking the plunge.

Despite being an excellent option for building wealth, real estate is only one of several options for retirement investing. If you are finding ways to maximize your retirement savings, then consider how to start investing in real estate.

Following are some of the critical benefits that make it such a compelling investment option:

Cash Flow: Rental earnings from real estate investments are one of the most attractive features of real estate. By leasing a property, investors can generate a steady stream of income, which can be utilized to offset mortgage payments, property taxes, and other expenses.

Equity Appreciation: Real estate investments tend to increase in value over time. Unlike stocks and bonds, real estate is subject to inflation and market trends, which can cause fluctuations in value. However, from a long-term investment perspective, real estate can be a perfect way to build equity.

Tax Benefits: Real estate investments can provide significant tax advantages. Investors can deduct expenses, like mortgage interest and depreciation, which can reduce their overall tax burden. Additionally, capital gains taxes on profits from real estate sales can be deferred or even eliminated if the investor reinvests the profits in another real estate property.

Leverage: Real estate investments allow investors to leverage their capital. By taking out a mortgage or loan, investors can purchase more properties than they could with their capital. This can lead to a more rapid return on investment, although it carries more risk.

Real estate is a fabulous way to build wealth and generate passive income. Real estate is a perfect investment option for those looking to build wealth and diversify their portfolio with the potential for stable cash flow, equity appreciation, tax benefits, and leveraging opportunities.

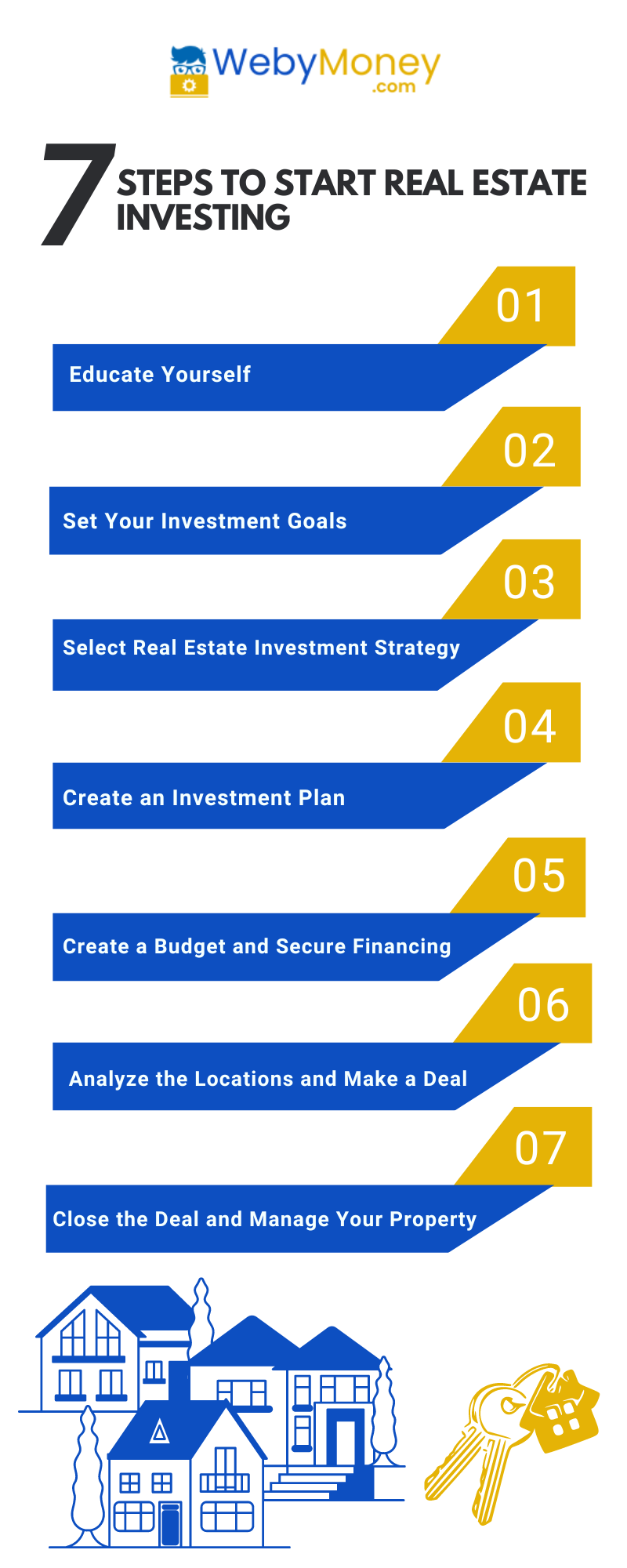

A Step-by-Step Guide to Start Real Estate Investing

Real estate investing is a profit-making way to grow wealth, but starting can take time and effort. Whether you're a beginner or have been investing for some time, there are specific steps you should take to ensure a successful real estate investing experience.

This guide will walk you through starting real estate investing. With simple steps and careful planning, anyone can succeed in real estate.

Here is a step-by-step guide to starting real estate investing:

Step-1 Educate Yourself

The most critical step for any real estate investor is to educate themselves. You don't require a degree or certification to be successful, but you need a good understanding of the basics.

Before you take the plunge and leap into the world of Zillow looking for foreclosures, you must understand and know from the experiences of other successful investors. Mistakes in real estate can set you back tens of thousands of dollars or more.

It pays to be informed to save the trouble and safeguard your finances. Discover the stories of those who have come before you by reading up on real estate investing, tuning in to podcasts, finding a mentor, and networking with nearby investors. Doing so could be the difference between winning and costly errors.

Start by researching the types of investments available, the legal aspects, and the real estate market. It would help if you also introduced yourself to the industry's terminology. This will aid you in comprehending how to evaluate properties, develop sound strategies, and make informed decisions. Consider taking an online real estate investing course or attending a seminar to get started.

Step-2 Set Your Investment Goals

The most essential step in real estate investing is setting your investment goals. A clear and straightforward plan will help you make informed decisions and keep you on track. You need to determine your long-term and short-term objectives.

Long-term objectives are usually focused on making money and building wealth. Short-term goals are often related to cash flow and income.

Write down your investment goals and make sure they are achievable. For example, if you like to retire early, set a realistic retirement age and figure out how much cash you need to reach that goal. Similarly, you must choose a strategy and plan for success to build a business.

Once you have your goals, it's time to start researching the different real estate investments. Consider the risk associated with each option and determine which one best suits your investment objectives.

If you have a clear plan and set your investment goals, you could make good decisions involving too much time or money. How about figuring out what you plan to achieve from real estate and writing down your long-term and short-term goals?

This will help you pick the right real estate investment strategy and hold you from making deals that could involve too much of your time or money. You'll be on the path toward financial freedom and success with the right investment goals.

Step-3 Select Real Estate Investment Strategy

If you like to start investing in real estate, you may wonder which strategies you should use. After all, there are multiple ways to invest in real estate, and choosing the right approach can make a tremendous distinction between winning and failure.

Fortunately, some tried-and-true strategies can help you get started in real estate investing.

Here are some of the most popular real estate investment strategies so you can decide which one suits you:

Crowdfunding:

Crowdfunding is a relatively new strategy that involves pooling money from many investors to buy a property. This is an incredible way to diversify your investments and spread the risk.

Real estate crowdfunding is the most effortless approach to putting money into property and an extraordinary method to begin if you have little capital. Rather than looking for one financial specialist to loan a lot of cash, crowdfunding empowers engineers to raise reserves through numerous minor individual speculations.

Organizations like Fundrise and EquityMultiple permit private financial specialists to begin contributing in land with as meager as $500.

Buy-and-Hold:

The buy-and-hold strategy is the most famous real estate investment strategy. This strategy involves purchasing a property, renting it out, and then holding onto it long-term. This strategy is mainly used by investors who want to benefit from the income generated from rental payments and property appreciation.

Fix-and-Flip:

The fix-and-flip strategy is a popular real estate investing strategy that involves purchasing, renovating, and reselling a property.

House flipping can be a valuable way to generate a profit quickly, provided that you have the financial means to purchase a property at a discounted price and make the necessary improvements before selling it. It's a fast-paced strategy that requires time and money but can yield a significant return with the proper approach. Convincingly, this is an ideal way to make money quickly.

House Hacking:

House hacking is one of the ideal real estate investing strategies involving purchasing a multi-unit property and then living in one unit while renting out the other. This strategy lets investors generate rental income while also profiting from the appreciation of the property.

House hacking is an option for those looking to reside in a property while renting out portions and essentially living at a minimal cost or even for free.

There are numerous approaches to house hacking, such as renting out rooms, purchasing a multi-residential building and leasing the other units, or renting out space or rooms through Airbnb.

Real Estate Investment Trusts (REITs):

REITs are a popular real estate investment strategy that lets investors invest in a portfolio of real estate investments without purchasing any properties. This strategy exposes investors to the real estate market without the risk of owning an individual property.

Vacation Rentals:

This approach involves buying a property in a desirable area and renting it out in the short term, such as through Airbnb. This strategy offers the potential for a high return but is also a higher-risk strategy.

Wholesaling:

Wholesale real estate is a terrific way to make money without wasting capital. It doesn't require any renovations, additions, or money invested in the property. All you need is a good eye for finding deals, patience, and a network of investors who want deals. The process of wholesaling real estate is quite simple.

First, a person or wholesaler uncovers a deal and sets a contract on the property with the seller. Then, they locate a buyer for the property, usually another real estate investor, and allocate the contract to the consumer at a higher price. The buyer delivers the wholesaler, and the wholesaler pays the seller, keeping the difference as their profit.

The key to successful wholesaling is to build a network of investors who want deals and be patient. You are required to take the time to research and find the best deals. You also need to be capable of spotting potential problems in deals before you get involved. Don't be afraid to leave a deal if it's not right for you.

If you're ready to invest time and effort, you could earn profit by wholesaling real estate.

These are just a few real estate investment strategies you can use to start real estate investing. Research and discover the best plan for your financial goals and risk tolerance.

You can quickly create your real estate portfolio and generate passive income with the proper strategy.

Step-4 Create an Investment Plan

Real estate can be a superb way to generate passive income and grow wealth. But without a well-crafted plan, you won't be able to make the most of the option.

Creating a plan helps you focus on your goals, assess risk tolerance, and identify suitable properties.

Creating an investment plan starts with defining your goals.

Ask yourself these questions:

What do you enjoy getting out of real estate investing?

Which real estate investments do you like to pursue?

What type of returns do you expect?

Have you evaluated the risk you're willing to take?

How much cash do you invest in real estate?

You can build your plan once you know what you want to accomplish.

Here are some critical steps to follow:

Research the market: Take the time to understand the real estate market in your area. Research the current prices, trends, and potential opportunities.

Set a budget: Establish a financial plan of how much you’ll need to invest and how much you’ll need to set aside for repairs and maintenance.

Create a timeline: Set a timeframe for when you want to purchase a property, when you plan to start renovations, and when you hope to start renting.

Understand your risk tolerance: Evaluate your risk tolerance and determine if you’ll be comfortable investing in different types of properties.

Develop a strategy: Create a strategy for buying, managing, and selling your investments.

Creating an investment plan can be complex but essential for success.

With a well-crafted plan, you can lay out your objectives, assess your risk tolerance, and create a strategy to reach your goals.

Start planning today to get your real estate investments on the right foot!

Step-5 Create a Budget and Secure Financing

Before investing in real estate, you must create a budget. Ensure you have the funds to cover mortgage payments, taxes, and maintenance costs.

When creating your budget, include short- and long-term expenses. Short-term expenses include closing costs, repairs, and other immediate costs associated with purchasing a property. Long-term expenses include mortgage payments, taxes, insurance, and maintenance costs.

List each property's potential expenses to get the right idea of how much money you need. This will give you an accurate image of how much funds you need to budget for each property.

Once you have a precise budget, you can start looking for financing options.

Various financing possibilities are available to real estate investors, such as secured loans, unsecured loans, and lines of credit.

Secured Loans:

Secured loans are more attractive to investors due to their lower interest rates, more significant down payment requirements, and the fact that they are backed by collateral such as property or additional assets. On the other hand,

Unsecured Loans:

Unsecured loans require no collateral but have higher interest rates.

Unsecured loans are an incredible way to get the cash you need without putting up any collateral. You don't have to stress about losing your real estate or car if you can't make payments. You can utilize the funds for home improvements, debt consolidation, or a significant purchase.

Unsecured loans offer lower interest rates and more flexible repayment terms. It means more cash in your pocket and less worry on your mind.

Lines of credit:

Lines of credit offer an excellent option for investors to borrow up to a certain amount and then pay it back over time, making it a compelling solution for those looking to borrow money.

These loans are generally more flexible and have lower interest rates. When looking for financing, shop around and compare rates and terms.

Also, look for lenders willing to work with you and understand the unique needs of real estate investors. Once you have secured financing, you can begin your real estate investing journey.

Creating and budgeting for financing is essential to your investments' success, so do your due diligence before diving.

Step-6 Analyze Locations and Make a Deal

Analyzing locations:

There is no definitive answer when selecting the best spot for real estate investing. You could succeed in expensive areas or fail in more affordable ones.

The key is to identify a location strategy that aligns with your goals. When deciding, you have two options: investing in properties close to home or going long distances. Both have benefits – you can view properties in person if you are close by and save money by self-managing, but deals may be more complex compared to remote areas.

To evaluate which method is more suitable for you, consider the advantages and flaws of each.

Do you want to be hands-on and be able to visit your property?

Or are you looking for a more passive approach that requires less direct involvement?

Evaluating the answers to these questions will assist you in determining the proper location strategy.

When it comes to analyzing locations, there are many factors you need to consider.

First, you should look at the area's population growth. Is the population increasing or decreasing? Are there any new businesses or developments that could bring people to the site? Are there any schools, parks, or other amenities nearby? These are the crucial questions to ask when scouting for investment opportunities.

Next, you should also consider the rental market for the area. What kind of rental rates are people willing to pay? What sort of return can you anticipate from a rental property? How many tenants are in the area, and what is the vacancy rate? All these factors can assist you in determining whether or not investing in the area is a good idea.

You should also consider the local economy. Are there any significant employers in the area? Are there any government subsidies or incentives available? Are there any tax benefits that could help you save money? These questions can aid you in making a well-informed decision about investing in a particular area.

Research Your Market:

Research the real estate market in the region and determine what type of properties will be in demand.

Consider the following aspects before making any decision:

Current market conditions

Price trends

Population growth

Economic indicators

Competition from other investors

Tax incentives

By exploring the local housing market, you can identify the best locations to invest in and determine the potential return on your investment.

Make a Deal:

Once you have located a property that fits your desired location criteria, it is time to consider whether or not it is a fair deal.

You can use several 'rules of thumb' as a guide to assist you in deciding if the property meets the necessary criteria and determining the best price you are ready to pay.

The 2% rules state that the rental income should be roughly one or two percent of the purchase price.

The 50% rule suggests that about half of your post-mortgage income should go towards property-related expenses.

The 70% rule suggests paying no more than 70% of the after-repair value.

While these 'rules of thumb' can rule out bad investments, one must also consider factors like property taxes, which may vary.

Ultimately, it is crucial to weigh all the benefits and flaws and do your research to make the best decision.

Understand all the terms of the Deal. This contains the amount of money you will be investing, the length of the lease, the terms of the purchase, and any other conditions that may be included.

Knowing the Deal's details will help you get the best value for your money.

Negotiating is an integral part of making a real estate deal. You need to be willing to negotiate to get the best deal possible. Don't be scared to ask the seller for a lower price or to try to negotiate a better deal.

Get professional advice. Getting professional advice when making a real estate deal is always good.

A real estate attorney or broker can help you ensure that the Deal is legal and that you make the best investment decision.

Step-7 Close the Deal and Manage Your Property

Close the Deal:

Close the Deal Once you've completed all the necessary steps, you're ready to close the Deal. This includes signing the closing documents and transferring the funds. Read the closing documents carefully and ensure everything is correct before signing.

Manage your Property:

Once you've closed the Deal, it's time to start managing your property. This may involve finding tenants, collecting rent, and handling maintenance and repairs.

Beginning the earnest labor, if you're flipping the home, you must act promptly to make a profit. You may be required to engage a contractor to supervise the job. To make it a rental property, you must determine how to administer it in the long run. If it's near, you can manage it on your own, but if it's distant or you lack the time, it's best to consider appointing a property manager. You should still be saving money even after purchasing the property.

Every property is distinct. Some need more maintenance reserves or have higher property taxes. Neglecting one line item in your plan can undermine your returns. You're investing blindly if you don't use a financial model for your properties.

Following these steps and learning to close the Deal and manage your property, you'll be on a profitable real estate investing journey.

Final Thoughts

Real estate is accessible to almost everyone with enthusiasm for the activity. It does not cost much, and innovative methods are used to fund and oversee properties. It is essential to remember that no plan or location is devoid of volatility and unpredictability.

Tenants may opt out of rent, buyers can be challenging to find, and unanticipated structural issues could arise. These are some of the threats associated with investing in real estate. It is essential to plan as best as possible. However, after that is done, it is necessary to stop researching and begin to act. The most critical steps are establishing a solid network with other real estate investors and having enough cash reserves to cater to any difficulties. These will not solve all the problems but will make the process easier.

Real estate investing can be fabulous for increasing wealth and financial independence. With the proper knowledge, resources, and guidance, you can start investing in real estate. The key is to discover a strategy that works for you, understand its risks and rewards, and take steps to ensure success. With the correct planning, you can start your real estate investing journey and begin to see the rewards that come with it.

Comments